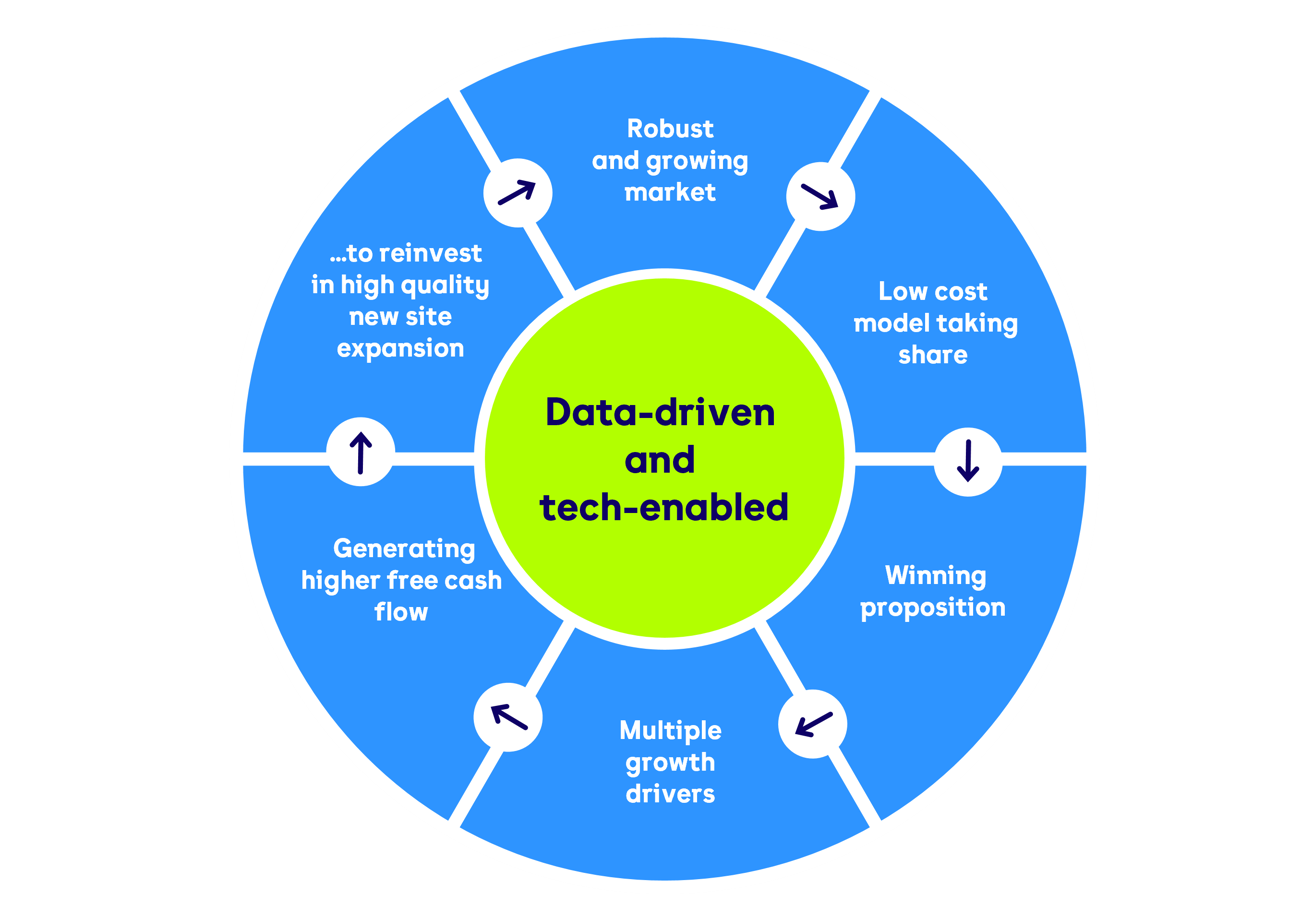

We have a compelling proposition in a robust and growing market for high value, low cost fitness, which can be scaled efficiently and sustainably. We take a data-driven approach, utilising technology and economies of scale to provide a demonstrably great value member experience, whilst also delivering strong financial returns.

What we do

- Market-leading low cost gym experience drives growth in membership base

- Significant advantages from scale-efficient model: operations, technology, brand and marketing

- With scale we can achieve strong financial returns which enable reinvestment to drive further growth

Our business model

Our Next Chapter growth plan

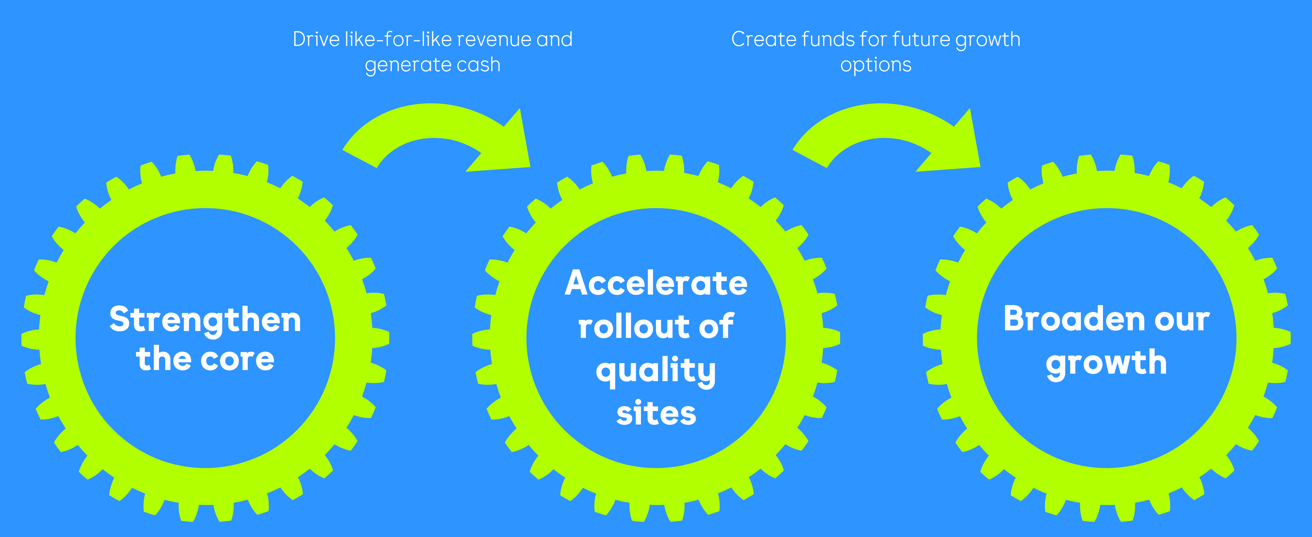

The framework of our Next Chapter growth plan is three components – firstly to ‘Strengthen the core’ of our business to increase returns from the existing estate. This funds the second part of the plan to ‘Accelerate rollout of quality sites’, in turn creating optionality to thirdly ‘Broaden our growth’ as we develop our proposition into new channels, new adjacencies and/or new markets.

Under our plan to ‘Strengthen the core’, we have identified a number of growth drivers that will deliver increased returns in our existing estate and underpin the attractive returns we continue to drive from our new sites.

The key initiatives under this plan fall into three categories

- Pricing and revenue management;

- Member acquisition; and

- Member retention

Each of these categories will contribute to like-for-like growth in our mature estate and provide an opportunity to access some of the potential new members we have identified.

As set out in the Market review section on pages 6 to 9, a PwC market study commissioned by The Gym Group and published in February 2024, suggests that there is the potential capacity for between 600 and 850 additional gyms in the low cost gym sector. At recent rates of site expansion by all low cost gym operators, this suggests there is scope for at least ten years of further growth.

We have identified the key characteristics of high-returning sites, and it is clear that Greater London and ‘Urban Residential’ locations deliver the best returns for us. This, therefore, is where we are concentrating our site opening programme for the time being. Disciplined rollout of high quality and high-returning sites will deliver attractive returns and create significant value for shareholders. Retaining discipline in selecting the right sites – in terms of location, footprint and local market – is critical to maintaining the attractive 30% target Return on Invested Capital (‘ROIC’) that the Group’s new site pipeline delivers.

The successful execution of the first two components of the Next Chapter plan will create further options to ‘Broaden our growth’ for the longer term. We continue to make a strategic assessment of the longer term growth options which may include further developments to our existing proposition; format innovation; investigating new channels to market; and introducing new adjacent revenue streams to complement our existing business.